23 Money Savings Tips That Could Help You Out.

Hacks that work for people.

Published 3 years ago

8

Mine would relate to food as well: - cultivate the skill of home cooking so you enjoy what you cook as much as a mid-range restaurant meal, and learn to enjoy the process so it doesn't feel like a chore. That way, when you're tired through the week, you can pull something yummy out of the fridge that costs a tiny percentage of what you would pay if you ordered delivery or went out. I was watching a TV show the other week (Gruen, in Australia) where one of the hosts said research suggests that only ten per cent of people actually enjoy cooking and both me and my husband turned to each other and said thank God we fall in that ten per cent! It saves so much money and feels financially empowering.

11

If you are planning on taking on new debt by financing a large purchase (car, house, etc.), calculate what the monthly payment would be then practice making that payment by putting that amount in a savings account each month. It gets you used to having that expense in your budget and helps you save up a down payment.

13

I try to frame expenses, especially “wants”, in terms of time. For example: this game/clothing item/electronic device is the equivalent of x hours/days of work - is it worth it to me? Especially when I think about it from a post-tax and deduction standpoint, it helps put things in more perspective for me.

15

I generally check Marketplace and local groups before I buy things like clothes, toys, baby gear and furniture (within reason, obviously there are some things that shouldn’t be bought used). If I can find it in good condition used, I’ll get it instead of buying new. I’ve saved heaps this way, and it’s better for the environment.

16

I live in a small apartment that hasn't been updated since 1970 and I drive an old car. I don't make a ton of money and I'm not particularly spendy in other areas, but I could be spending $700 or $800 more in fixed costs easy if I rented and drove "what I could afford." A few times a year I get the bug to move into a nicer apartment, but instead I spend a few hundred bucks on a new rug or jazzy wallpaper or new sheets.

19

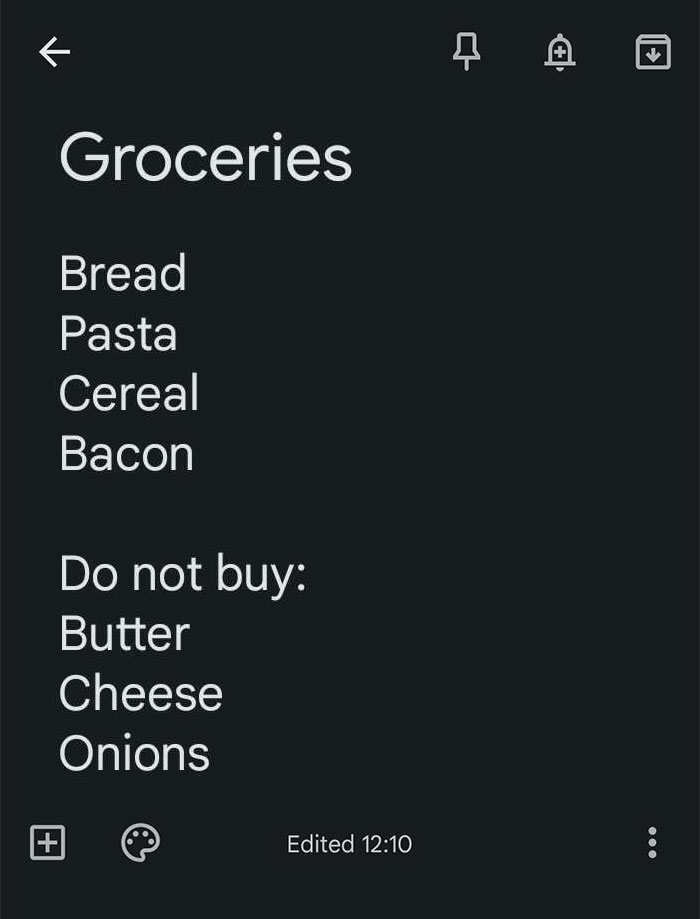

For me it would be meal planning! Pre-COVID my husband and I never planned meals. He would get lunch at the cafeteria at his work and I would either eat snacks or walk to the nearest fast food place by my office. One of us would call or text the other on the way home from work with the dreaded what’s for dinner question which meant we would hitting the store almost nightly. It also meant we ended up buying things we already had at home. When we moved two years ago I found SIX jars of dried basil! We were also going out to eat a lot. When the lockdowns happened going to the store every day wasn’t advised or safe so I started planning out our meals and what we could reuse for multiple meals. We would spend so much less on food when I would check what we already had first and make a list. We also stopped needing to grab takeout as much. The habit stuck and I’ll never go back to how it was before.

20

If you’re in a shopping mood, go to a thrift shop! Sometimes I just want a new item and that itch can be scratched with a $5 skirt or a $8 dish rather than $$$ at a regular shop - bonus, there often aren’t that many items you want, so it stops you from buying up the whole shop, and secondly, items are often good quality and will last longer than getting something from target.

23

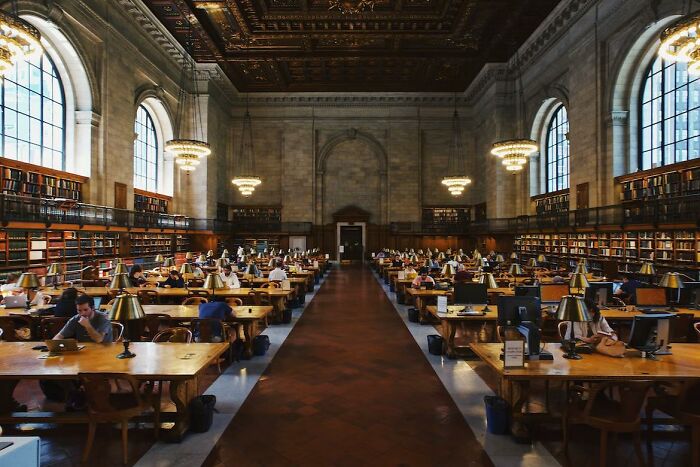

I use the public library. I'm an avid, fast reader. It makes no sense for me to buy books because I finish them (usually) fairly quickly. I have a shelf of favorites, but other than that, I frequent the public library, whether it's using my Kindle or getting physical copies. They're also great for fun, free events, classes, etc.