Bad news for thieves, scammers and basically everyone except for that one woman on Extreme Cheapskates who stole her family’s belongings throughout the year only to return them at Christmas time, well before EOY — the IRS is coming for you.

With Al Capone Remembrance Day Tax Day on the horizon, the IRS’s policies on stolen property, bribes and other dubiously acquired goods and/or cash have started to make the rounds on Twitter, reiterating that it doesn’t matter how you acquired it, Uncle Sam wants his cut.

a friendly tax season reminder to report all income from illegal activities and stolen property pic.twitter.com/WhoKeYQrmS

— derek guy (@dieworkwear) March 5, 2023

“Income from illegal activities, such as money from dealing illegal drugs, must be included in your income on Schedule 1 (Form 1040), line 8z, or on Schedule C (Form 1040) if from your self-employment activity,” read a now-viral snippet of the agency’s 2022 Publication 17, also noting that “if you receive a bribe, include it in your income.”

the trick is to steal a car on January 1st, return it on December 31st, and then steal it again the next day so you don't have to pay taxes

— derek guy (@dieworkwear) March 5, 2023

So what exactly constitutes a taxable amount in terms of bribes or theft? The answer, it seems, is pretty much anything, as tax preparer Gary Schroeder explained last year during the provision’s first viral foray.

“All income, from whatever source, is taxable income, unless excluded by an act of Congress,” he told NBC News. “If you receive $500 to kill your neighbor’s annoying rooster, or find $1 on the street, or embezzle from your employer, that’s all taxable income, as well as your paycheck from flipping burgers at McDonald's.”

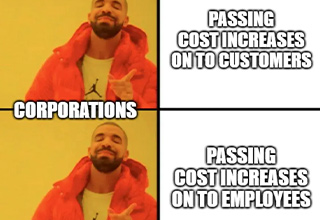

the thief realizing that he is about to be robbed by the IRS lol pic.twitter.com/k6fjupyRfx

— Aert2me (@Aert2Me) March 5, 2023

Welp. if you’ll excuse me, I have a ton of hoodies to promptly return. You already broke my heart, Alex, you’re not gonna take me down like a 1920’s bootlegger.

1 Comments